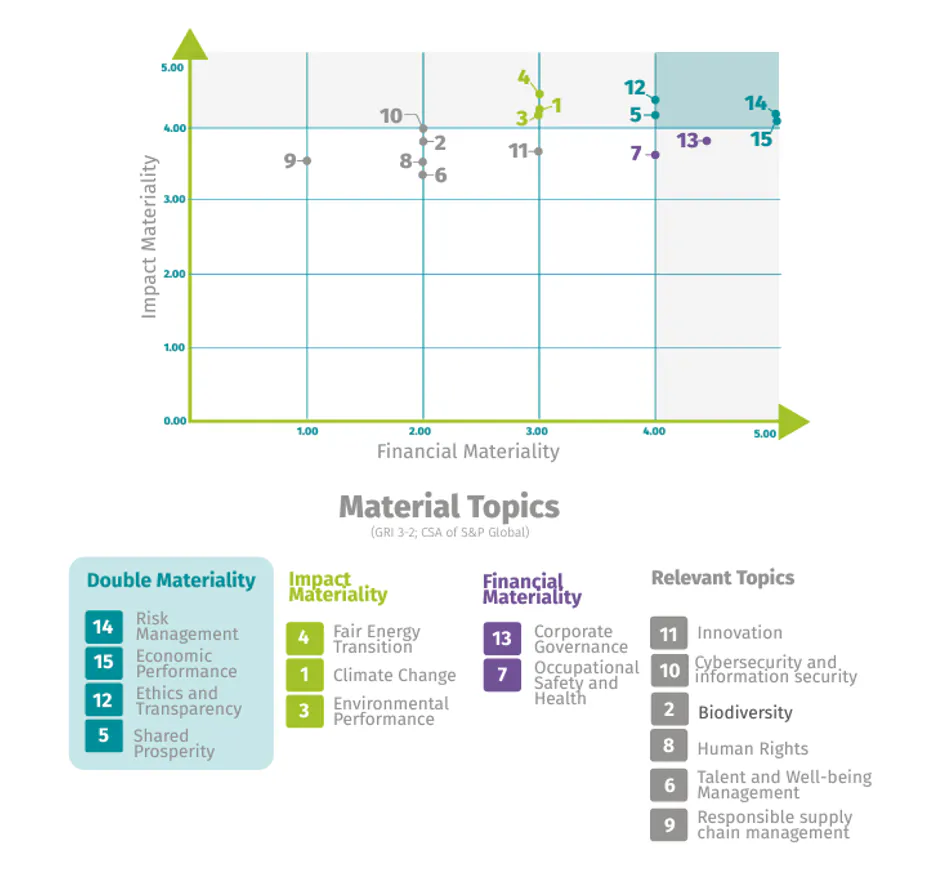

In 2023, GEB updated its material issues with the double materiality approach, which identifies and prioritizes the Company's impacts, risks and opportunities from a perspective of impact materiality (of GEB on the environment) and financial materiality (of the environment on GEB). The update of the double materiality includes GEB (the holding company) and its controlled subsidiaries Enlaza (Colombia), Transportadora de Gas Internacional – TGI (Colombia), Conecta (Guatemala), Electrodunas (Perú), Cálidda (Perú) y Contugas (Perú).

This exercise was developed using as reference some guidelines from the European Sustainability Reporting Guidelines 1 ESRG1 of the European Financial Reporting Advisory Group (EFRAG) as well as the Universal Standard 3: Material Issues 2021 of the Global Reporting Initiative GRI, as well as other documents, methodologies and guidelines related to the evaluation of impacts, risks and opportunities.

The result of this exercise allows GEB to prioritize the Environmental, Social and Governance issues that it must manage, in line with its Corporate Strategy, Sustainability Strategy and the current context in which the Company develops its operations.

The materiality analysis process involves the following stages

A documentary review of international references and relevant internal inputs from GEB was carried out to identify Internal and External Stakeholders.

The documentary review included corporate policies, procedures and reports from GEB and its subsidiaries, reports from leading companies in the sector and international standards.

Once the stakeholders/sub-stakeholders were identified, a workshop was held to prioritize them under the attributes of dependency and influence.

As a result, the following stakeholders were prioritized:

• Board of Directors

• Investors and shareholders

• Customers

• Trade associations

• Employees

• Government and regulatory entities

• Local communities

• Suppliers and Contractors

• Partners

• Subsidiaries

This exercise was developed using as reference some guidelines from the European Sustainability Reporting Guidelines 1 ESRG1 of the European Financial Reporting Advisory Group (EFRAG) as well as the Universal Standard 3: Material Issues 2021 of the Global Reporting Initiative GRI, as well as other documents, methodologies and guidelines related to the evaluation of impacts, risks and opportunities.

Understanding the context is composed of two main activities:

- Understanding the context of the organization and its value chain: in order to achieve a holistic understanding of the organization and thus place the GEB within a context of sustainability, a review of internal inputs such as policies was carried out, corporate commitments and strategies. A total of 8 inputs were reviewed

- Studying trends and standards and benchmarking companies in the sector: the analysis of these external sources sought to understand the state of the art related to the Company’s environment to understand the challenges and opportunities that the sector and GEB is facing or will face in the short or medium term. Also, 15 Sustainability Reports of peer companies were reviewed, where material issues reported were identified.Likewise, the review of nine (9) ESG standards and rating companies was important to analyze the regulatory and normative requirements that could apply to the organization in the short term, and with this, design a double materiality exercise to respond in advance to such requirements.The information collected allowed the identification of 111 ESG sub-themes and sub-sub-themes, which would subsequently be associated with the IROs, in order to define the preliminary ESG issues to prioritize.

- Identification of Impacts, Risks and Opportunities – IROs

In this stage, we sought to identify those IROs caused by environmental, social and governance issues that could generate effects for the organization or the environment (economy, environment and people).

- First, more than 93 risks were evaluated, coming from the strategic risk matrices of Grupo Energía Bogotá and its subsidiaries. A risk clean-up exercise was carried out to identify risks that dealt with similar issues. From this process, 30 strategic risks were selected. In turn, two additional risks from other sources were identified, giving a total of 32 risks.Regarding opportunities (positive risks), there was information provided by the areas in the IRO survey, the opportunities submitted for the 2023 Integrated Report, as well as meetings with the Risk, Planning and Innovation areas of the company. Additionally, opportunities identified in Grupo Energía Bogotá’s TCFD Report were taken into account. As a result of this process, 11 opportunities were identified. Secondly, for the identification and analysis of impacts, the information provided by the areas in the IRO survey was used, as well as the impacts submitted for the 2023 Integrated Report. Likewise, the Company’s 2022 Integrated Report and other reports from industry peers were analyzed. This process allowed the selection of 51 impacts.

Once the IROs of Grupo Energía Bogotá were identified and associated with industry trends and the Company's future objectives, the identified ESG subtopics were grouped into preliminary ESG issues.

This list of preliminary issues was subjected to an approval process with the GEB Sustainability and Communications team to define the final list of issues to be associated with the identified IROs. These discussions resulted in a list of 15 preliminary ESG issues. The resulting ESG issues are shown below, with their respective associated subtopics.

- Climate change: Adaptation to climate change; Mitigation and compensation of climate change.

- Biodiversity: Ecosystem services; Protection and conservation of biodiversity; Mitigation and compensation of environmental impacts; Ecosystem restoration.

- Environmental performance: Use of natural resources; Atmospheric emissions; Energy efficiency; Water management; Waste management.

- Just energy transition: Low carbon technologies; Competitive energy.

- Shared prosperity: Territorial development; Access to products and services; Relationship with communities.

- Talent management and well-being: Working conditions; Employment practices; Adequate salary; Strengthening skills; Talent attraction and retention; Corporate culture.

- Occupational Safety and Health: Health and safety at work for employees and contractors.

- Human rights: Diversity, equity and inclusion; Due diligence; Training and awareness; Human rights risk management.

- Responsible supply chain management: Local supply.

- Ethics and transparency: Responsible business conduct; Conflict of interests; Corruption and bribery; Taxation; Information management.

- Corporate governance: Management of subsidiaries; Ownership structure; Transition of boards of directors.

- Risk management: Critical incident risk management; Emergency preparedness; Process security; Third party actions.

- Cybersecurity and information security: Information security; Cybersecurity risks.

- Innovation: Digital transformation; Innovation ecosystem; Culture and knowledge management; New businesses; New technologies.

- Economic performance: Business profitability; Generation of value for investors and shareholders.

Impact materiality

For each of the 15 preliminary ESG issues, an evaluation was carried out of the impacts generated by Grupo Energía Bogotá in the environment identified. Subsequently, an evaluation was carried out of the preliminary ESG issues, associated with the impacts, through stakeholder consultation using didactic tools, surveys, interviews and field visits.

In these consultation with stakeholders, the participants rated the ESG issues according to the magnitude of the effect they have on the environment based on the understanding of the question “How serious/significant/important is it to the environment or society the fact that Grupo Energía Bogotá - GEB and its subsidiaries manage (or not) these issues?", as well as the probability of occurrence by answering the question "How likely is it that Grupo Energía Bogotá - GEB and its subsidiaries will have an impact ( positive or negative) in the environment and/or society by managing (or not) these issues?”

Financial materiality

The financial materiality addressed, for each of the preliminary ESG issues, the rating of the risks and opportunities. In this step, a value was assigned to each risk and opportunity based on the analysis of the possible financial effect that their materialization could generate in the Company; Each of these risks and opportunities was associated with one of the ESG issues presented in the previous step. This process was developed with GEB’s financial, business and risk management areas.

Based on the rating of risks and opportunities, and the number of risks and opportunities associated with ESG issues, a score for the financial materiality of each issue was calculated.

Prioritization of material issues

Biodiversity, Talent and Well-being Management, Human Rights, Responsible Supply Chain Management, Cybersecurity and Information Security and Innovation issues valued as relevant, These are issues that, despite not having been prioritized in the double materiality assessment, are fundamental issues for the fulfillment of the GEB's strategic objectives.

Risk management at GEB and its subsidiaries is framed in its strategic priorities and is consistent with the cultural attributes, capacities, roles and responsibilities, ensuring fulfillment of the Corporate Risk Management Policy, which establishes the framework for action and the commitments made in this regard, as well as the understanding and application of the Comprehensive Risk Management Model, which is based on the application of international management standards.

GEB’s material issues are those its stakeholders consider important and that, given the magnitude of their economic, social and environmental implications, determine the direction, priorities and scope of the company’s management. These issues also guide the objectives, goals and actions of GEB, its subsidiaries, and the work teams transversally.

Taking this into account, since material issues are strategic, they are integrated into the company's risk management system and are regularly monitored.

The following is a list of GEB's material issues and its relation to strategic risks:

Issue | Associated Strategic Risks |

Climate Change |

|

Biodiversity |

|

Environmental performance |

|

Just energy transition |

|

Shared prosperity |

|

Talent management and well-being |

|

Health and safety at work |

|

Human rights |

|

Responsible supply chain management |

|

Ethics and transparency |

|

Corporate governance |

|

Risk management |

|

Cybersecurity and information security |

|

Innovation |

|

Economic performance |

|

The process of involving external and internal interest groups, updating materiality and its results, were presented to GEB´s Steering Committee for review and recommendation.

The Sustainability Integrated Report 2023 and the results of the update on materiality were approved at the regular meeting of the General Meeting of Shareholders of Grupo Energía Bogotá on March 26, 2024, according to Minutes 092, following the recommendation of the Corporate Governance and Sustainability Committee of the Board of Directors and the Board of Directors.